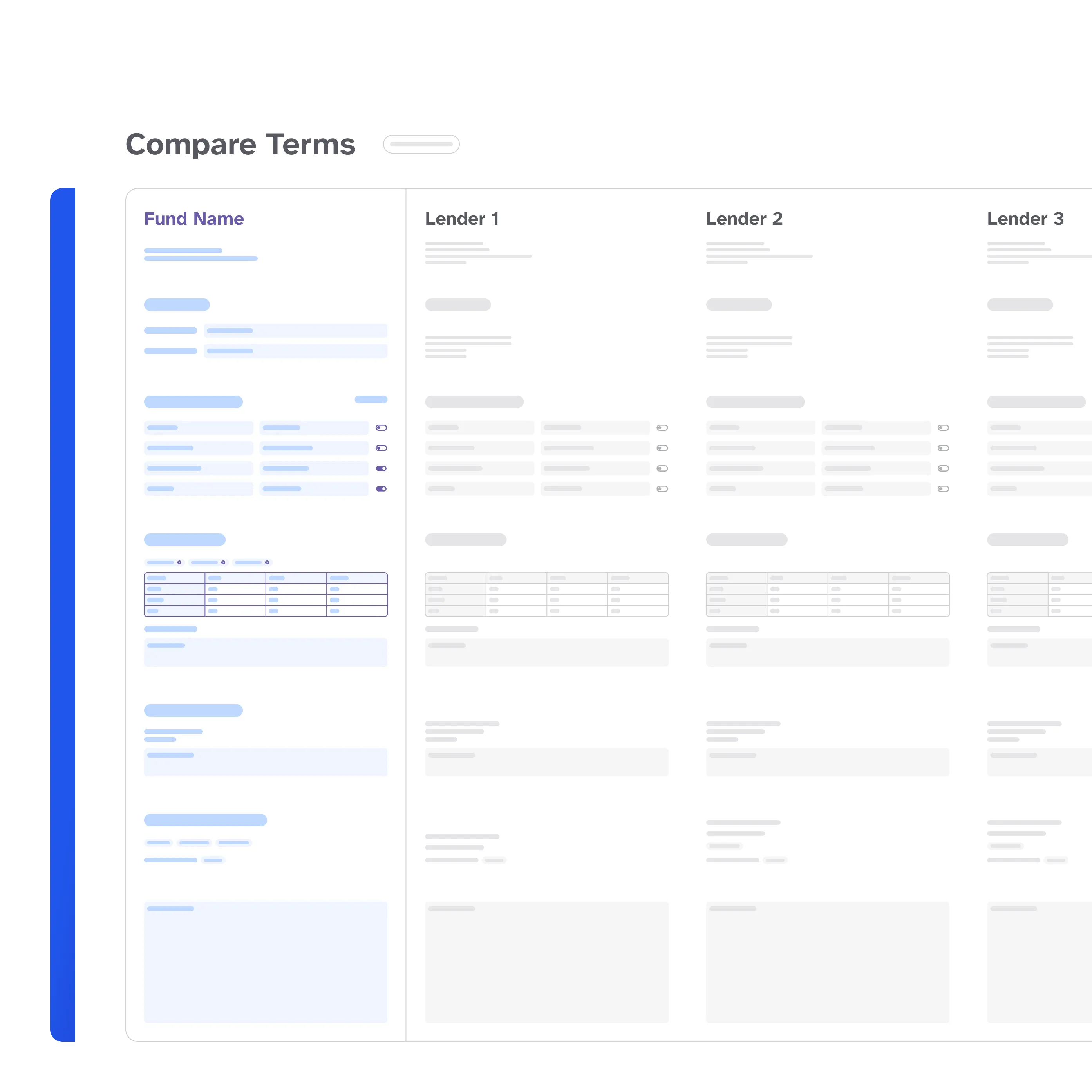

Source capital providers.

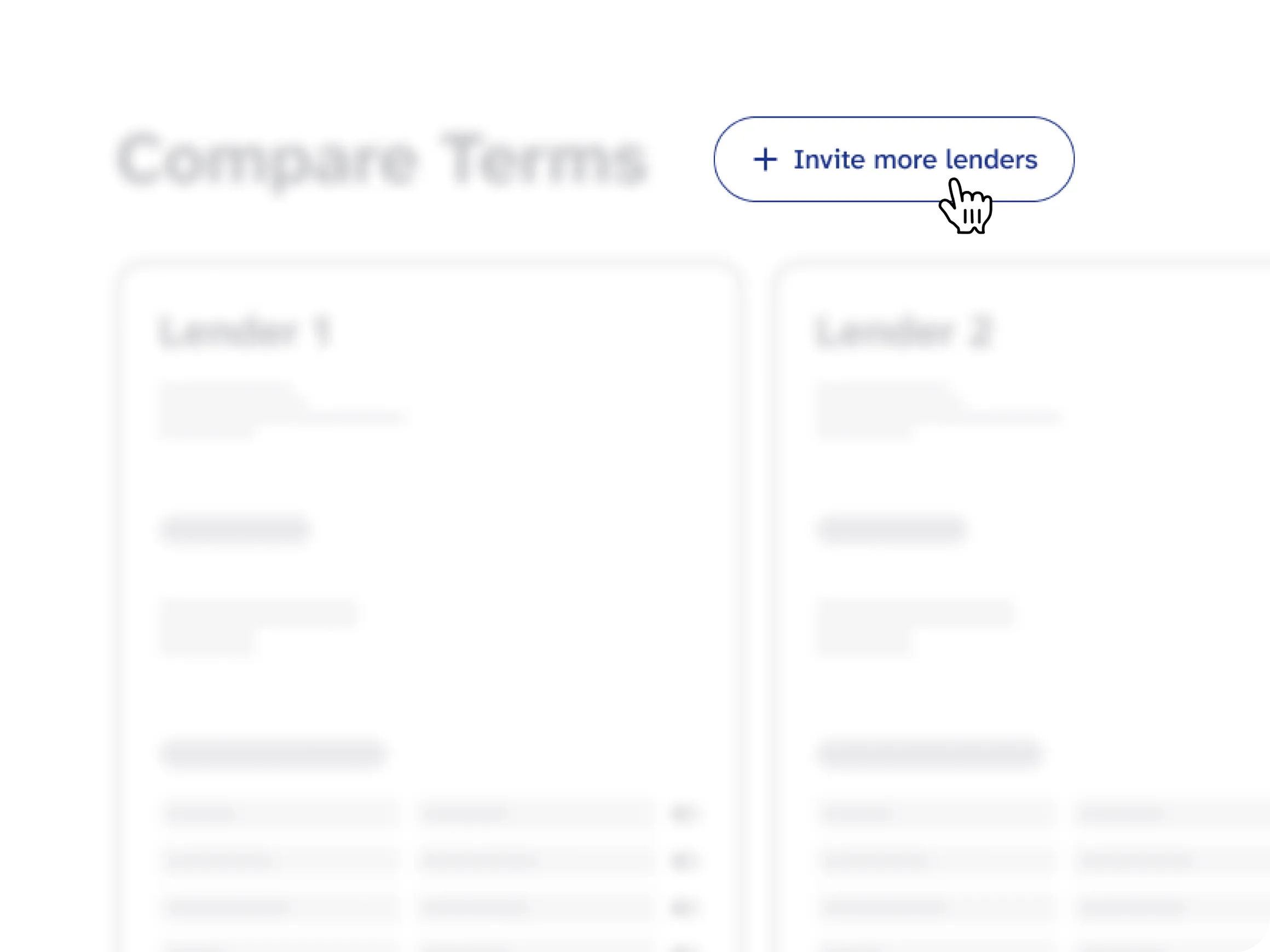

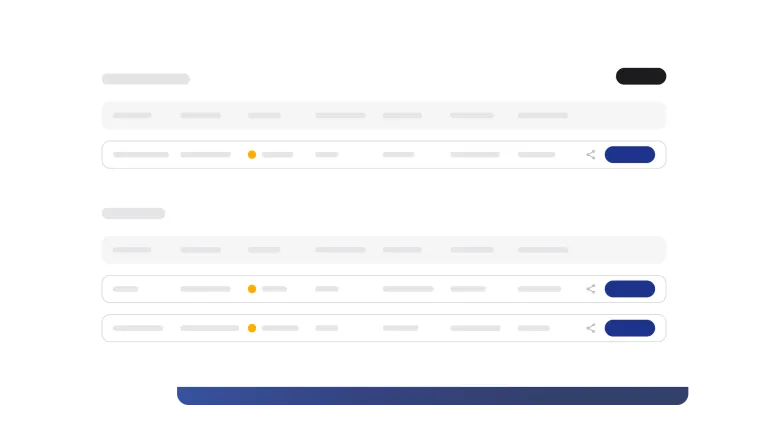

Expand or adjust your lender pool with precision. Beyond existing relationships, Bridge can also instantly connect you with the right active lenders across the market.

Why it works

Bridge makes fund finance easier, faster, and cheaper. It combines efficiency with transparency, ensures fiduciary obligations are met, and positions all private market fund managers at the forefront of a market that is rapidly adopting technology-led solutions.

Relationships

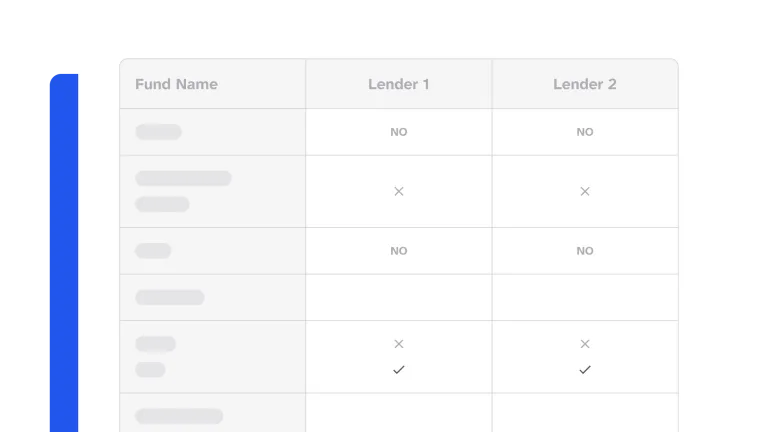

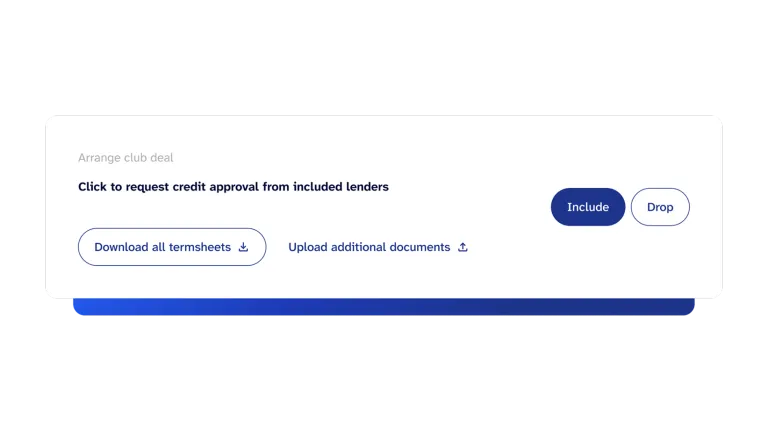

Bridge makes it easy to collaborate centrally with preferred banks and lenders. Arrange term sheet and longer form processes with all party and lender specific interaction on one screen. Where real time meets real relationship.

Fiduciary duty

Bridge ensures fund managers obtain the best terms for their investors. Streamline negotiations, end back-and-forth emails, and time consuming admin. Operational best practice - achieved fast.

Time and cost saving

By removing unnecessary admin, capital markets and finance teams at large cap institutions through to first time fund managers free up valuable time to focus on more strategic work.

What borrowers say

Bridge makes fund finance easier, faster, and cheaper. It combines efficiency with transparency, ensures fiduciary obligations are met, and positions all private market fund managers at the forefront of a market that is rapidly adopting technology-led solutions.